Calculate depreciation on furniture

To calculate the straight line depreciation rate for your asset simply subtract the salvage value from the. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

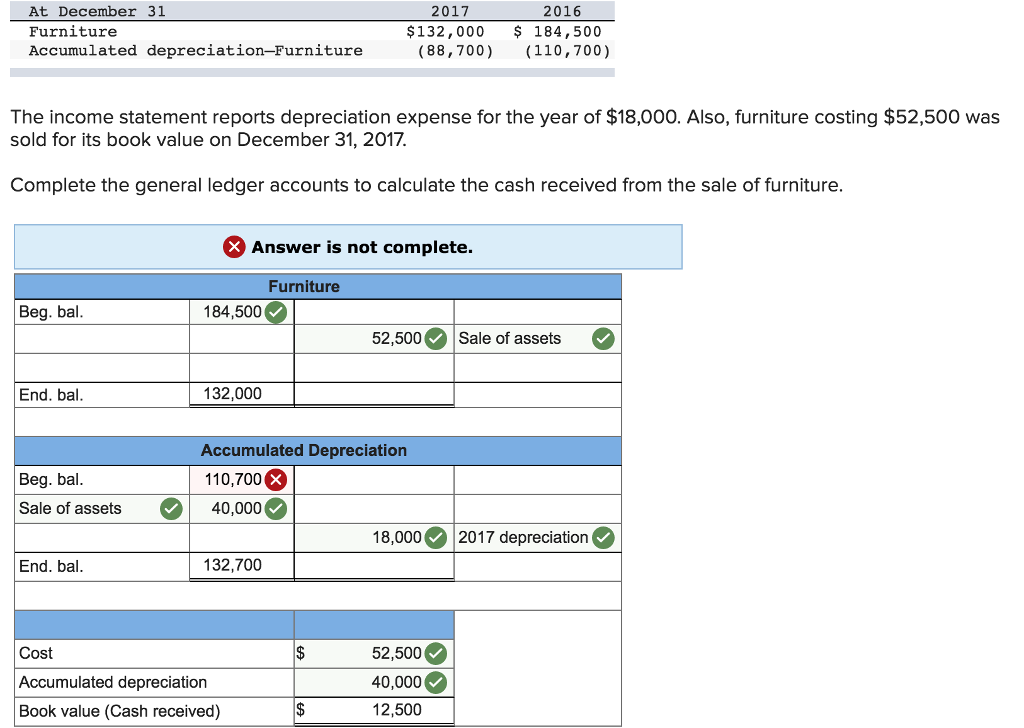

Solved At December 31 Furniture Accumulated Chegg Com

The straight-line method means you divide the value by its useful life.

. You subtract the salvage value of the furniture from the original cost then divide the difference by the useful life. Straight-line depreciation offers the easiest calculation. The total number of units that the asset can produce.

This represents the annual. Wooden furniture and upholstered seat manufacturing. Divide the cost of the furniture 19500 by the useful life 8.

The calculator should be used as a general guide only. In year one you multiply the cost or beginning book value by 50. Based on the Debit and Credit or.

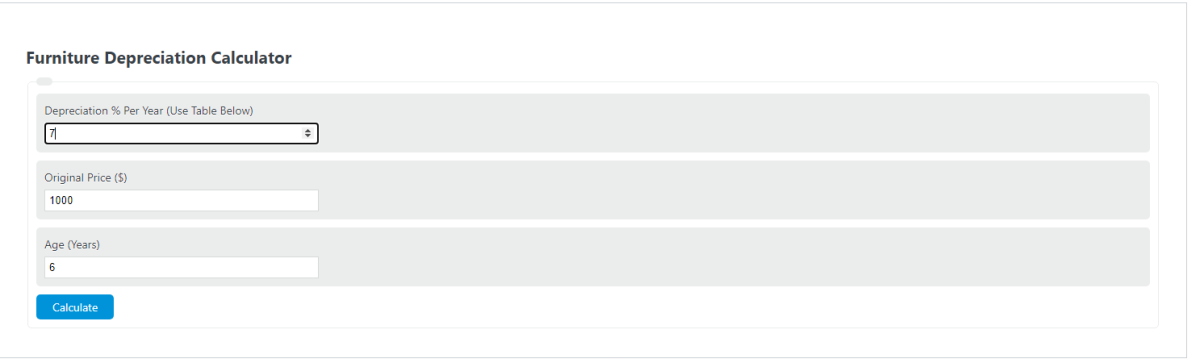

How To Calculate Straight Line Depreciation Formula Straight line depreciation. Straight-line depreciation subtracts the salvage value of the furniture an estimated value of the asset once it reaches its supposed end-of-life from its original cost. Furniture Depreciation Calculator The calculator should be used as a general guide only.

This is the amount you need to write off every year. To calculate depreciation you need to know. Depreciation per year Asset Cost - Salvage.

You can use different methods to calculate depreciation. With this method the depreciation is expressed by the total number of units produced vs. There are many variables which can affect an items life expectancy that should be taken into consideration.

To Furniture Ac Being depreciation charged on furniture Depreciation Ac Debit because of depreciation one type of expense expense are also debit. The cost of the asset asset basis including costs for buying the asset shipping setup and. How To Calculate Depreciation.

There are many variables which can affect an items life expectancy that should be taken into. You then find the year-one. The calculation is 30000 8 or 2437.

The DDB rate of depreciation is twice the straight-line method. Calculate annual depreciation expense. Doing this will give you an average depreciation.

Year 1 Depreciation 9 55 x 1000 200 Depreciation 016 x 800 Depreciation. Under the SYD method heres how you can calculate the furnitures depreciation. The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life.

Depreciation Nonprofit Accounting Basics

Depreciation Formula Calculate Depreciation Expense

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Assets And Liabilities Spreadsheet Template Balance Sheet Template Spreadsheet Template Balance Sheet

How To Calculate Depreciation On Furniture Sapling Colorful Interior Design Paint Colors For Living Room Studio Apartment Furniture

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

![]()

Furniture Calculator Splitwise

Furniture Depreciation Calculator Calculator Academy

How To Calculate Depreciation Expense For Business

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Accumulated Depreciation Explained Bench Accounting

Editable Balance And Income Statement Income Statement Balance Etsy In 2022 Income Statement Small Business Plan Template Financial Statement

Furniture Depreciation Calculator Calculator Academy

Solved The Following Selected Information Is From Ellerby Chegg Com

Depreciation A Decline In The Value Of Property The Opposite Of Appreciation Real Estate Education Real Estate Marketing Design Real Estate Agent Marketing

How Much Does Furniture Depreciate Ultimate Guide

Depreciation Nonprofit Accounting Basics